Quick Start – CRM Basics

Welcome to

BNTouch!

Thank you for choosing BNTouch for your

CRM solution. Our platform is filled with tools and features to help your

mortgage business run smoothly, efficiently, and profitably. Starting here, you

can learn what BNTouch has in store for your business, how to access and use

the various elements of the CRM, and how to get the most out of them in your

day-to-day operations.

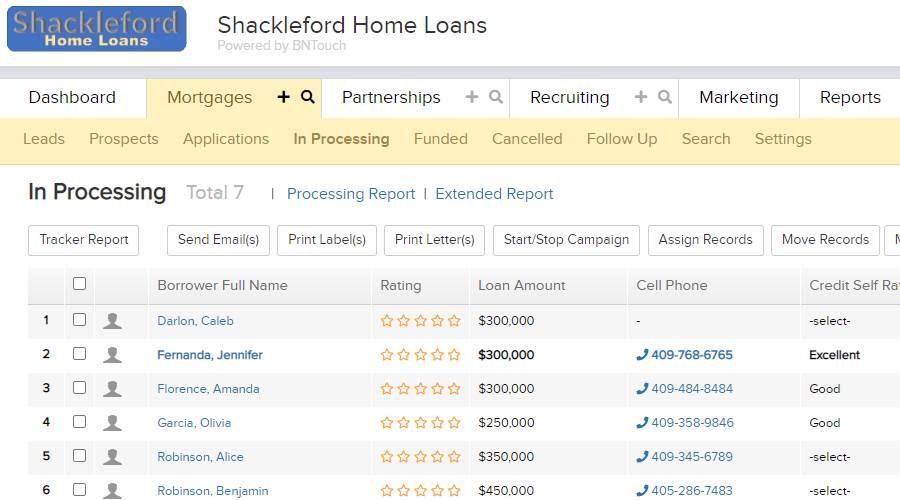

First, let’s go over the basics of our

CRM. At its core, our CRM can be used to manage your borrower information and

stay in touch with them. It can also be used to manage your realtors and other

partners that are participants in your loans. Our database management allows

you to start a client as a lead, move them to a prospect, and follow as they submit an application, enter processing, and eventually

reach funded status. Beyond this, it can also be used to follow up with clients

and keep track of any that have canceled.

BNTouch can also keep track of your

conversations and communications, like your voicemail and email, and keeps time

stamps on these communications to organize your work. Our CRM allows you to

communicate directly through the system through email, SMS text messages,

mobile app messages, and customized portal websites. These communications can

be handled before, during, and after transactions.

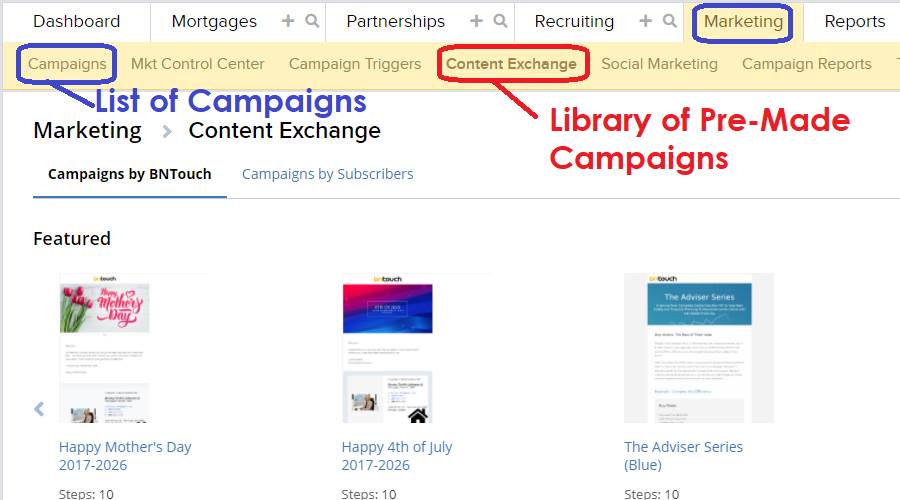

Our marketing system allows you to stay

in touch with everyone by building your own campaigns or using pre-built ones

from our content exchange. Our CRM uses automation for these campaigns to save

you time and make your life easier.

Keep Your

Information Organized, Accessible, and Consistent

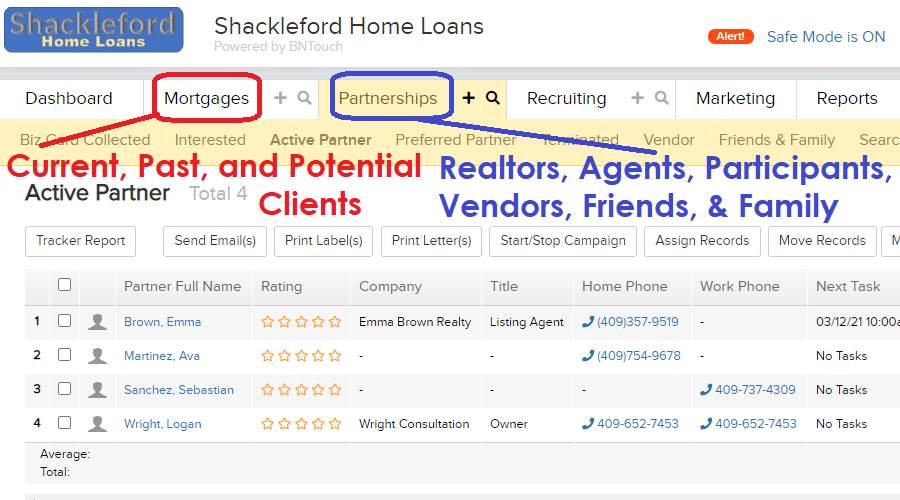

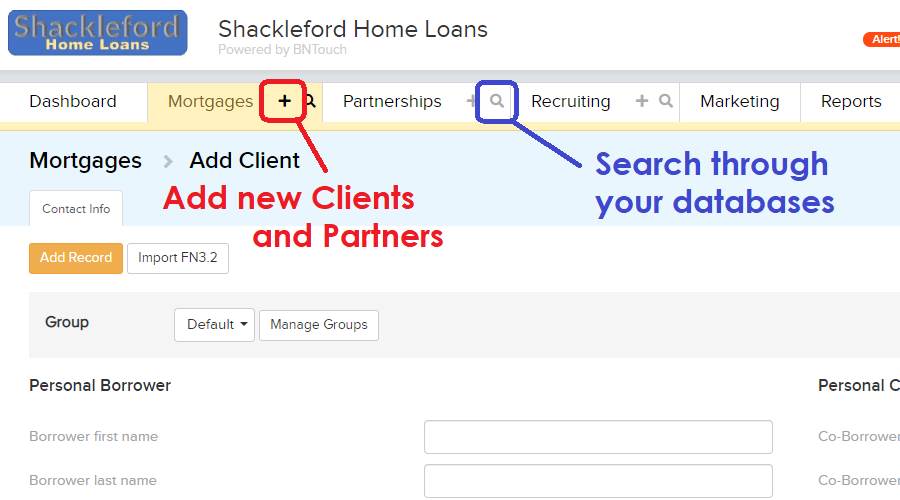

The two main places where your client

information will be stored are the Mortgages and Partnerships tabs. Your

borrower database in the Mortgages tab is specifically for current clients,

prospective clients, and past borrowers. Your partner database in the

Partnerships tab, on the other hand, is for your realtors and anyone else who

participates in a mortgage transaction with you. You can also keep track of

vendors, friends, and family members here to handle your communication with

them.

If you have the BNTouch mobile app

downloaded, you can even stay in touch with your clients and partners, manage

your marketing campaigns, and keep track of your business information while on

the road, letting you build relationships face-to-face. You can then enter the people

you meet into your CRM, and using automated rules called ‘triggers,’ marketing

campaigns can be started for these records and ‘drip’ on these clients. You can

even take care of holiday greetings and monthly newsletters to keep yourself

‘top of mind’ with your clients on an ongoing basis.

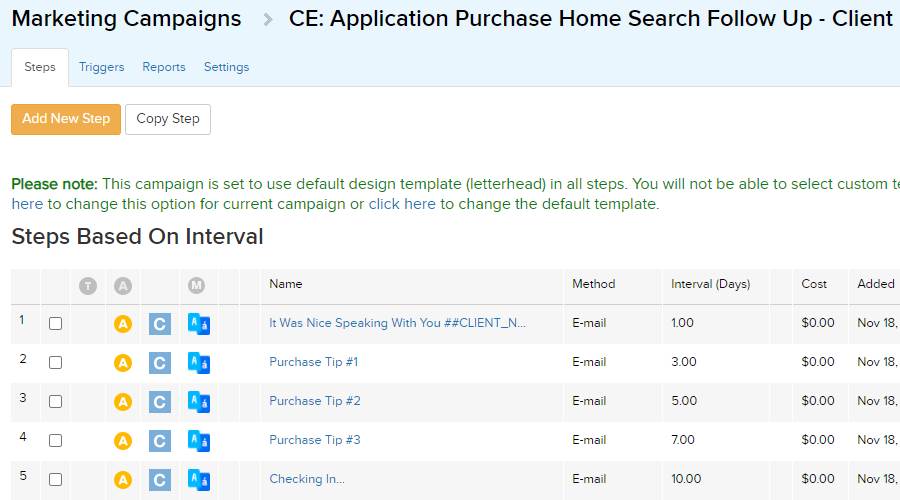

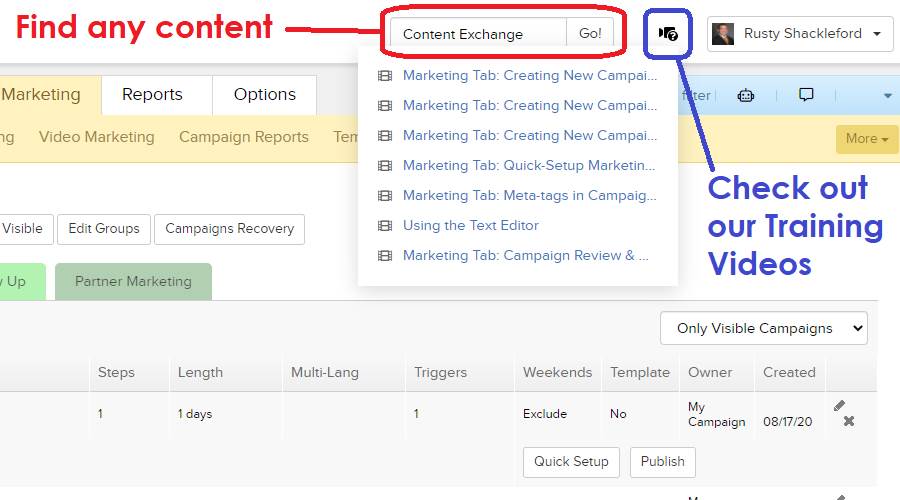

Speaking of marketing campaigns, you’ll

find that you have many options available in BNTouch, including holiday and

birthday campaigns, time-change reminders, newsletters, in-processing

campaigns, partner-focused campaigns, and those used to keep in touch with

current and past partners. These campaigns can be easily pulled for use in your

business from our Content Exchange, a large library of pre-made campaigns. You

can also make campaigns from scratch if you prefer!

Notes to Self:

the Dashboard, Tasks, and Reports

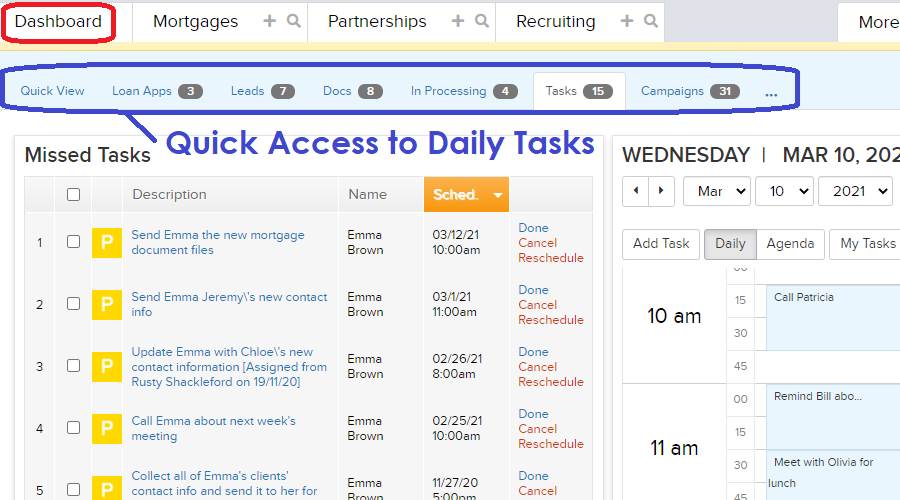

In addition to marketing campaigns

focused on your clients, you can also set tasks and reminders for yourself and

your staff to help organize your own time. The same automated triggers can be

used to keep yourself on-track with changes in your pipeline, including

reminders to make calls at set intervals, communicating new information with

your partners, and more.

The CRM is organized into several tabs at

the top of the page. Our Dashboard has several functions that help you stay on

task in your CRM, including a calendar that shows your tasks and agenda, making

them easy to navigate and update. You’ll have separate databases for your

Mortgage clients and Partners, and you can even keep tracks of your Recruiting

in a database as well. In addition, you can always search through all the

information in your CRM using the box above, including clients, partners,

campaigns, and more. If you need help at any time, look for the Video Icon in

the upper-right corner of the screen to access training materials for whatever

page you are currently using.

You can always access detailed

information about your business and the records in your databases from the

various reports in our Reports tab. You can also use the Options Tab to set

Alerts and Notifications for yourself to automatically receive reminders and a

daily digest of your tasks. Similar daily reports can be sent for your

requested documents and in-processing records, and a report on your marketing

status can be sent out each week.

Mortgage and

Partnership Records

Records can be added to your databases in

BNTouch in many ways. You can add clients or partners manually by clicking the

“+” sign markers by the Mortgages or Partnerships tabs, which can help when you

need to add a single record at a time. To save time, you can also use

spreadsheets with record information, including lists of leads, past records,

or current partners, and import several records at once in the Options tab.

You’ll need to do this separately for your borrowers and your partners, but

this can still save you from having to enter each record one-by-one.

You can also create Web Forms to gather

information for records directly into your database when clients or partners

fill out the forms. These forms can be put on a website, loaded on a signature

page, or made available elsewhere to gather marketing contact information.

If you use a Loan Origination Software,

BNTouch can often sync with these systems to bring information into your CRM automatically.

This can be used to continually update your CRM as new information comes in

from your LOS system. You can also save your records as Fannie Mae 3.2 files

and import them into your LOS software and vice versa. To sync information from

your LOS, you’ll need to submit a ticket to our support staff for help.

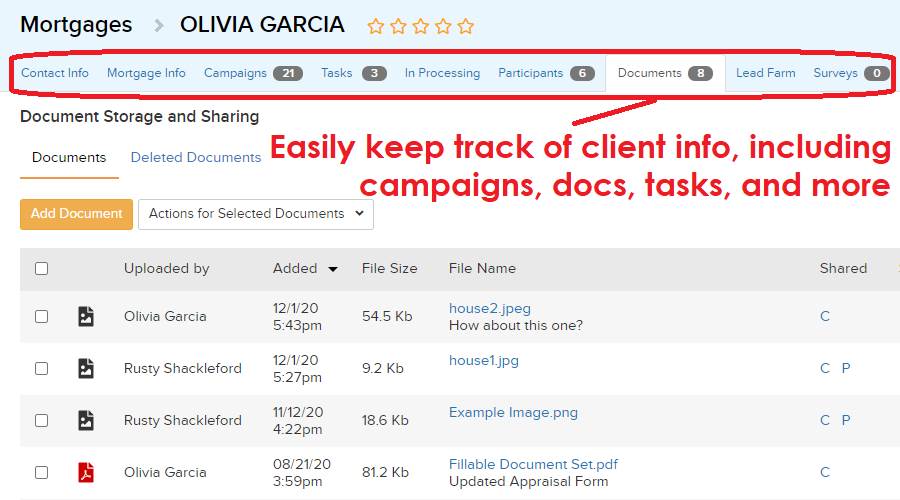

In each client’s record, information is

separated into sub-tabs for organization. The Contact Info area can be used to

keep borrower and co-borrower information, including phone numbers, email

addresses, and such. Mortgage Information has expandable and collapsible

sections that organize mortgage, loan, purchase, program, and other types of

information.

Also, you can create tasks from within a

client record. This will make a reminder for you that is linked to the client’s

record, making it easy to remember the client and access their information

later. These tasks can also be generated from automated campaigns, so you can

remind yourself, for example, to communicate with a client after a certain

number of days. Tasks are helpful in several ways. Even if you forget to

complete a task, the task will appear in a “Missed Tasks” list in your

Dashboard tab. This will help you on-task and prevent anything from slipping

through the cracks.

The “In Processing” sub-tab allows you to

track each client’s progress through the mortgage process. You can enter actual

and projected dates for each step, add comments for later reference, and check

reports for all records In Processing for your business.

In each mortgage record, you can link

your partners as “participants”. This will keep them updated when the record

progresses through the pipeline and when information is added or updated for

the record. You can request that client send you documents and keep them attached

to their records in your system, and the CRM can send routine reminders until

the client uploads said documents through our secure portal. Additional

sub-tabs in each Mortgage or Partnership record can be used to maintain a lead

farm, analyze refinance options for your clients, or switch between multiple

loans for the same record.

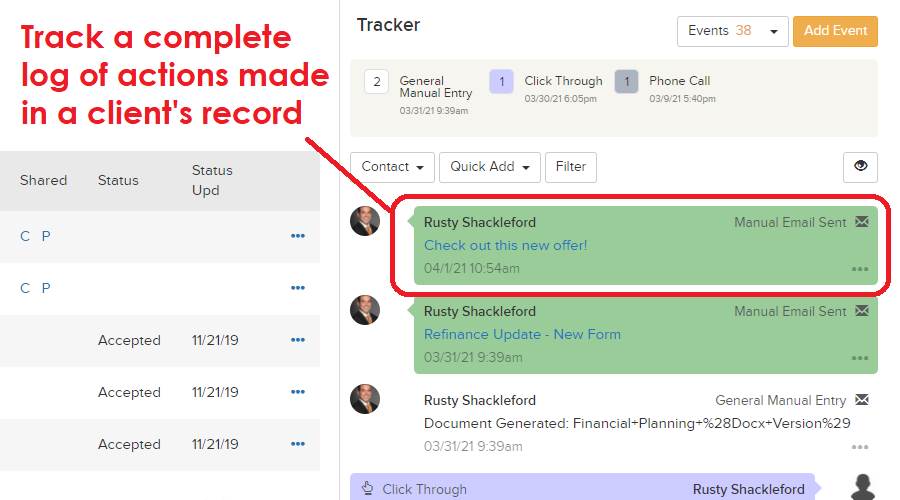

Further, a Tracker is available to the

right of each record; this keeps track of what communication and updates have

taken place for this record and by whom. Some types of entries will

automatically appear here, but you can also create your own tracker events by

clicking “Add Event”. This way, you can make notes on client records for

yourself and your staff. To the right of each screen, you can see “The Latest”

changes and updates that have taken place in your CRM through each day. The “Recent”

tab can be used to see the last records you accessed. This way, you can easily

re-open records and communications you have been working on that day without

getting lost.

Automating Your

Marketing Communication

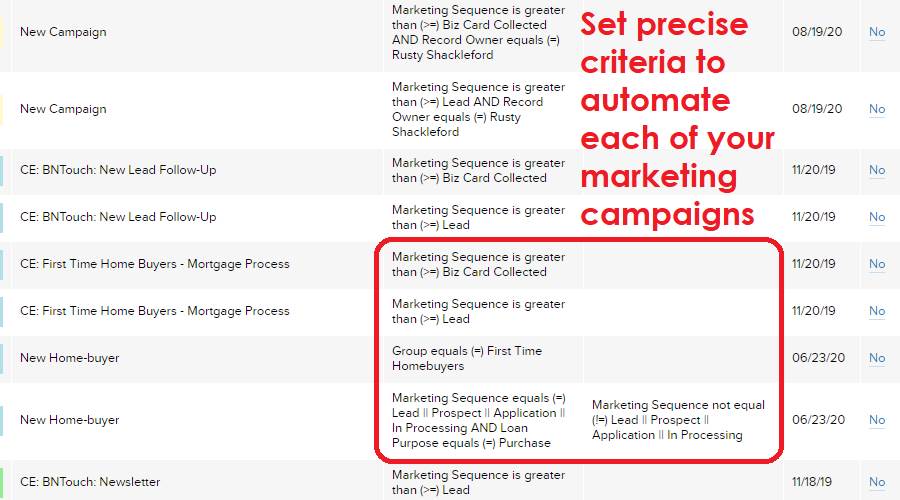

Adding clients to campaigns is easy as

well. Of course, you can quickly add clients manually to campaigns by finding

them in the Mortgages or Partnerships tabs, checking their records, clicking

“Start/Stop Campaign,” and choosing the appropriate campaign. You can also use

the Campaigns sub-tab in a record to start, pause, or remove any campaign for

that record. The easiest way, however, is to set your campaigns up with

automated triggers. These will tell your system, depending on what kind of

record it is, which part of the marketing sequence pipeline it is in, and other

criteria, can be used to automatically add the record to the campaign. For

example, this can be used to automatically add new homebuyers to a particular

campaign.

Setting up these rules can take a bit of

time, but they will save you much more time overall. Every day, you can take

just a few minutes in your day to improve your automation in your CRM—in no

time, you’ll find yourself becoming a top-producer. Our CRM is really meant to

help you stay in touch with your clients and to keep on track with your

business.

What should I do

next?

This article is only a general overview

of your CRM and is meant to serve as a starting point for learning more. If you

would like to continue this “tour” of your CRM and learn the fundaments of

marketing, start with the “Marketing

Basics” article or training video.

If you would instead like to start a full

training for your CRM in which you learn what each feature does in each tab,

you should begin our Initial Training series with the first part, “Account

Setup”. This article and video will help you configure options for your

account, and the rest of the Initial Training series will progress through each

section of your CRM in order, giving you a more complete understanding of its

capabilities and the opportunities available for your business.

Want to Learn More?