Mortgages – Contact and Mortgage Information

Managing Contact

and Mortgage Details in a Borrower Record

In the BNTouch CRM, your Mortgages Tab

functions as a database of all of your borrowers, and

each mortgage record allows you to store information, communicate with, and

perform other actions regarding that individual borrower. In

order to enable the many tools and features throughout your CRM, each

record can track contact information and mortgage details for your clients. The

information you enter for each borrower will be used elsewhere in your CRM for

campaign triggers, calendar reminders, email communication, and more.

Contact Info

Sub-Tab

In the Mortgages Tab, you can open any

client’s record by clicking their blue “Name” link. Here, the data stored for

the borrower is separated into a series of sub-tabs at the top of the page.

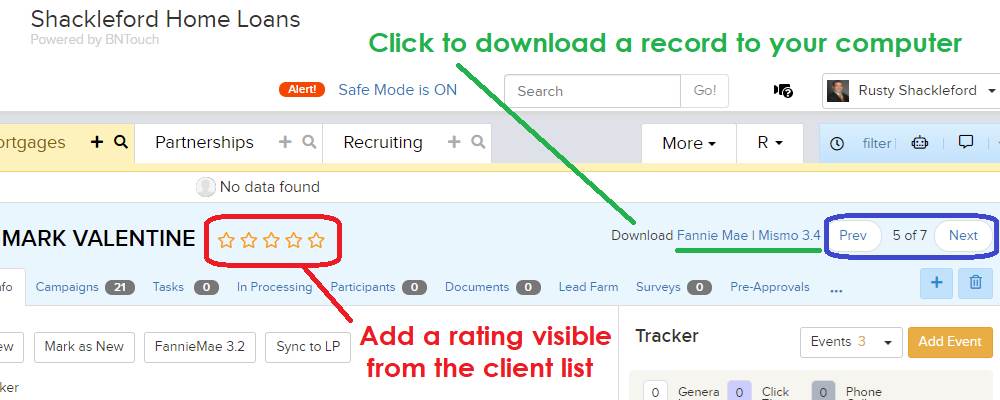

Above these tabs, you can use the “Star” icons to rank clients, the “Download”

links to save the record as a Fannie Mae or Mismo 3.4

file on your computer, or the “Prev” and “Next”

buttons to switch to other records in the same organizational section. If you

clicked on a client’s record in the “Prospects” marketing step, for example,

you would see other Prospect records.

The first sub-tab, Contact Info, contains

basic information for the borrower. This includes personal information like

their name, social security number, and date of birth, various types of contact

information, their preferred language, their mailing address, and social media

links. To the right, you can also enter data for the co-borrower if applicable.

The “Preferred Language” drop-down menu

can be set here to ensure they receive the most effective marketing material.

If your marketing campaigns use the multi-language feature, any that are sent

to this client will automatically match their preferred language.

A photo and logo can be uploaded from

your computer for each record to personalize each borrower in your CRM. To the

right, you can enter any miscellaneous information you need, as well as the

source of the lead and their time zone.

The “Individual Portal Password” is what

the client will use to access their Borrower Portal, a customized mini-website that allows your mortgage clients to

communicate with you, complete loan applications, receive and submit documents,

and more.

If you add, change, or remove any

information in a client’s record, remember to click the “Update Record” button

below before navigating away to save your work. For security reasons, any

changes to a borrower or co-borrower’s Social Security Number will only be

saved if the boxes next to these fields have been checked.

Mortgage Info

Specific details for the borrower’s

mortgage can be managed in the Mortgage Info sub-tab. Here, data fields are

organized into collapsible sections that can be expanded or hidden by clicking

the section header. These headers will display how many fields are contained

therein as well as the number that have been filled out.

The current status

of collapsed and expanded fields can be saved for the record using the “Save

View” button at the top of the record. When you re-open the client’s record,

the collapsible sections will be opened or closed in the same configuration as

they were when you saved the view.

Many fields are included in this sub-tab

regarding the client’s status in your system, their employment and loan

information, details about their property, answers to survey questions, and

even personal details. Many of these fields will be referenced elsewhere in

your CRM, so be sure to fill in as much information as you can in order to get the most out of BNTouch.

For example, the “System” category has important

status fields for the client’s presence in your CRM. Their step in your

Marketing Sequence can be changed here as well as their status. If the record

was imported from a LOS software, you can see the filename of the client here,

too.

Any miscellaneous fields that have been

enabled will appear in the “Extra Fields” section, which can be customized by

your administrator.

The “Mark as New” button will make the

record appear in bold in the Mortgage Record List as if it had not been opened

yet. If you connect your CRM with an external LOS, you can save the record as a

Fannie Mae 3.2 file by entering a filename in the “LOS Filename” field,

updating the client’s record, then clicking the “Fannie Mae 3.2” button at the

top of the page. If you use the BNTouch 1003 loan application, you can access

the “1003post” “FNM” file in the “Documents” sub-tab of the client’s record.

If you want any changes to mortgage

fields to be logged in this client’s record, check the “Log changes into

Tracker” button. This will create a new Tracker event whenever data is changed and the mortgage record is updated.

The area to the right will be an overview

of the record in your system. The green buttons can be used to opt the borrower

in or out for mailing, calling, emailing, or borrower portal communication. If

your administrator has enabled the BNTouch Voice module for your account, you

can click the phone number links here to call the client directly from your

computer.

The portal “Invite” link can be used to

invite the borrower to access their portal site. You can access their portal as

they would see it using the “Click to Visit” link, and you can send an invite

that contains the borrower’s portal password by clicking the “With Password”

link.

The buttons below can be used to instantly

send an email, print a mailing label, print a letter from your Documents

Library, or send an SMS message to the borrower and/or co-borrower if you have

the requisite modules enabled.

Want to Learn More?