Mortgages – In-Processing Status

Updating an

In-Processing Mortgage Record Status

As your clients progress through the

steps of applying for, gaining approval for, and receiving a mortgage for a

home, you need to be aware of the details of this process to help them along.

In the BNTouch CRM, you can easily track what stage of the mortgage process

each borrower is in at any given time. Further, you can log the actual and

projected dates of each step, enter comments for your own record, and read

reports about the current status of each of your

clients in this process.

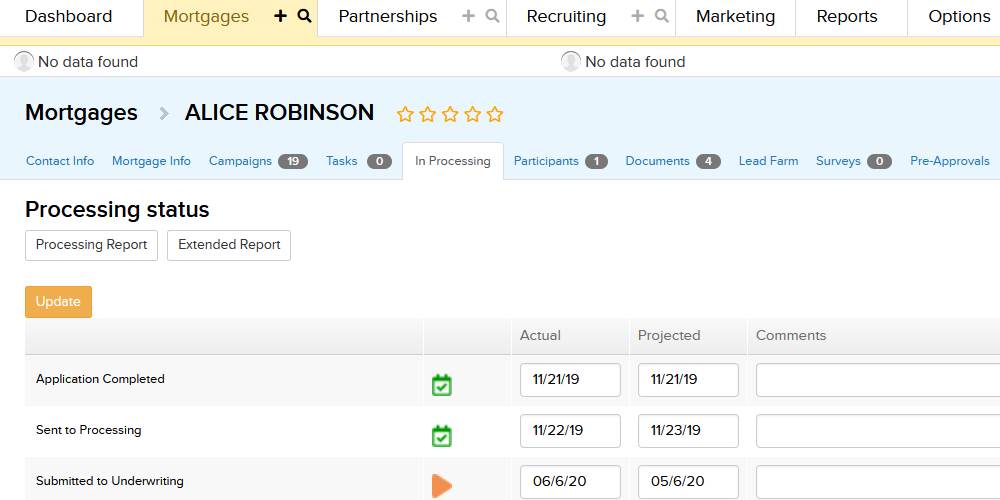

Viewing a

Client’s In-Processing Log

In the Mortgages Tab, you can open any

client’s record by clicking their blue “Name” link. The “In-Processing” sub-tab

is used to track the dates of each milestone the borrower reaches in the loan

process. For each step, from completing their loan application to successfully

funding their loan, you can note the date the borrower is projected to meet

that goal, when they actually complete it, and any

notes for you and your co-workers regarding their mortgage process.

Dates can be modified manually here by

clicking in any of the date fields and selecting a date on the calendar. If

your CRM is set to sync with an LOS or other external software, these dates

will automatically update to match.

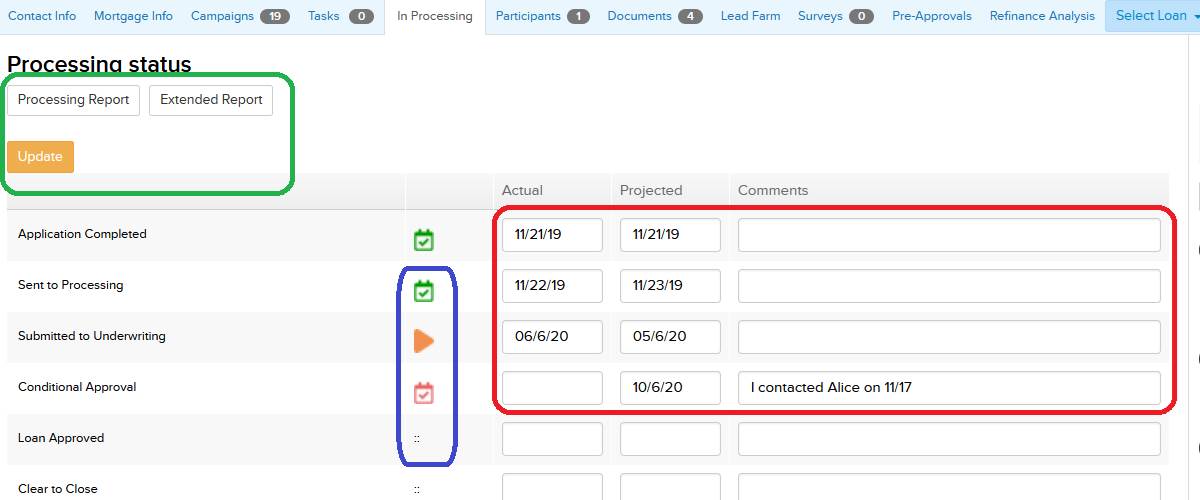

These dates also will affect the

indicators to the left of the text fields for each stage. A green checkmark

icon will appear for any steps that have an “Actual Date” that have passed

either before or on the projected date. If the actual progress has been delayed

and the “Actual” date takes place after the “Projected” date, an orange arrow

icon will appear. Any steps that have passed the “Projected” date and have not

been actually completed will be marked with a red

checkmark.

If you change any dates or enter any

comments in this log, be sure to click the “Update” button above or below the

list to save your work. Any changes to dates here can trigger marketing

campaigns. If a campaign has an automated trigger that is set to a specific

In-Processing Stage will activate for the borrower if a date is entered in that

field. Those that are set to look for the “Current or Last Completed

In-Processing Stage” will trigger once a date is entered for the selected

stage.

In-Processing

Reports

In addition to tracking an individual

client’s progress through their mortgage milestones, you can also see an

overview of these processes using the Processing Reports. These can be accessed

using the buttons above any client’s milestone log in the “In-Processing”

sub-tab or via the “Reports” tab of your CRM.

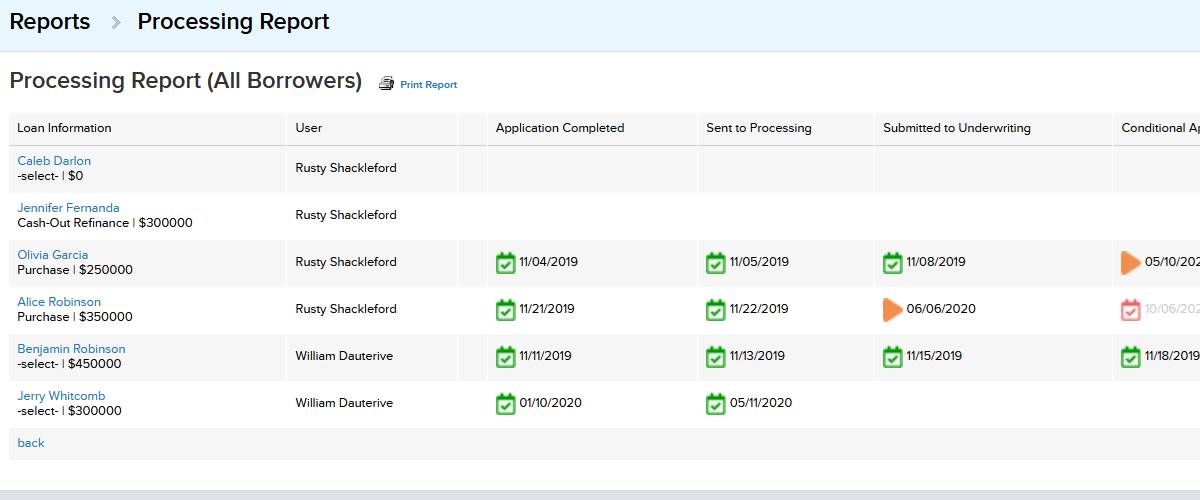

The first option is the “Processing

Report”. This will show the same basic details available when viewing an

individual client’s “In-Processing” sub-tab, but you will be able to see all

clients that are currently in-processing at the same time. You can jump to any

client’s file by clicking on their blue “Name” link to the left, and the CRM

user account that the client is assigned to will be listed here as well. To the

right, each complete milestone will appear as a date with the same indicator

icons that appear in the “In-Processing” sub-tab. You can print this report

using the link above the list.

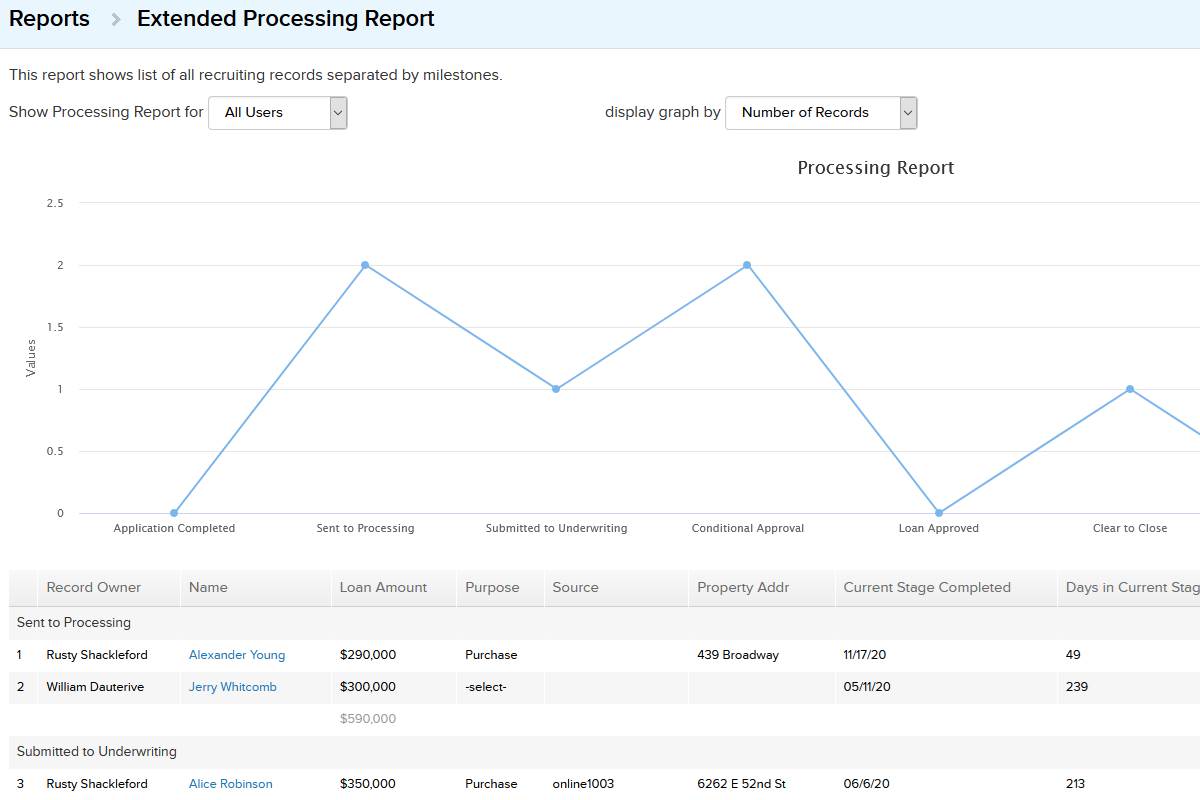

The second option is the “Extended

Processing Report”. This report shows more detail for your company’s

in-processing clients and represents their status with a helpful graph. At the

top of the page, you can choose to include clients for all users or limit it to

a specific account using the drop-down menu. You can also select whether the

graph will identify the number of records at each in-processing stage or the

total of the loan amounts of each client at each stage. Lastly, you can choose

to include additional data fields from your CRM in this report by clicking the

“Extra Fields” link, then selecting fields from the drop-down menus that

appear. Once you have selected all options for the report, click the “Go”

button to generate it.

The graph will note the records or total

loan amounts for each in-processing stage and points in a line, and you can

hover over each of these to view the exact numbers. Below, you can see a

breakdown of the records for each stage, jump to each client’s record in your

CRM, and view the information included from your selected extra fields as

columns to the right. This report can be downloaded as a “.CSV” file using the

link above the graph.

Want to Learn More?