Mortgages – Refinance Analysis

Show Refinance

Savings To Your Borrowers

The Refinance Analysis tool in BNTouch

allows you to create clear and concise presentations for your clients about the

possible benefits of refinancing.

It is easy to access—just open any record

in your Mortgages tab. In the sub-tabs above the record, look to the right for

“Refinance Analysis.” The first step in generating an analysis for your client

is to click the “New Refinance Analysis” button. This will open the tool, and

you can see that it has already brought in information from the client’s

records into the “Your Current Loan” section on the left.

Creating a

Refinance Presentation

Here, you can enter “Proposed Loan”

information to the right for a new refinanced loan. If you want to compare

several options, you can simply click the “Add Scenario” link to add another

column. When you are ready to create a presentation, hit the “Calculate”

button. If any required information is missing, the tool will help you avoid

mistakes by identifying missing details. Once everything is entered, the

Refinance Analysis will update the columns below with loan details.

The section on the left represents the

client’s current loan, and the right shows the proposed refinance options you

entered before. This comparison breaks down the information in a simple,

easy-to-understand way that will help your clients see the potential benefits

of a refinance. Below each piece of information, the Refinance Analysis tool

will explain the savings differences between the client’s current loan and each

proposal option.

In addition, you can select any of the

refinance scenarios as the “Best” option using the links above. Whichever

scenario you mark as “Best” will be highlighted in the comparison columns, and

contrasts will be explained in further detail between the client’s “current”

loan and the “best” option.

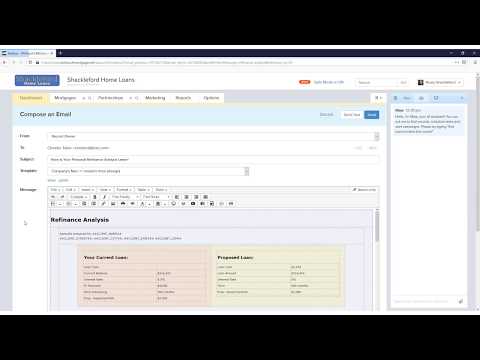

Below the presentation, you’ll have a “Save” button, which can be used to keep this

comparison for later. You can also click the “Preview and Send” button to bring

the presentation into an email that can be sent to the client. This will work

with your current email template and all other email features in BNTouch.

Customizing Your

Refinance Disclosure

One element that appears in that email is

a disclosure—which you can customize for your own business with this tool. Back

in “Refinance Analysis” section of the client’s record, you can click the

“Customize Disclosure” button.

Here, you can edit the disclosure text

that will be added to these Refinance Analysis emails. If you want to set what

you have to the default, just hit the button to the top-right. If you are

logged into an administrator account, you can also customize the disclosure

text for your company here, then just hit the “Save” button.

View Previous

Refinance Comparisons

You’ll also notice that previously saved analyses will be listed in the

borrower’s record when you open the “Refinance Analysis” sub-tab. This lets you

see any previously generated analysis, and you can still use the information

here to send an email to your client by clicking the “Email Analysis” button.

If you want to add or change any information, the “Edit” button will re-open

the analysis for any modifications.

One of these analyses can be made

available to your clients via a Borrower Portal by clicking the “Show on

Portal” button. To make a different analysis available, just click the button

for that analysis to update the default option.

Want to Learn More?