Marketing – Advanced Marketing Triggger

Examples

Advanced

Marketing Triggers and How to Use Them

In BNTouch, “triggers” are criteria that

you can use to automate your marketing. A trigger is simply a rule that tells

BNTouch when to add someone to a marketing campaign and when to remove them.

Every time you add or update someone’s information in BNTouch, your CRM will

compare that information to these triggers and decide if that person needs to

be added to a campaign, removed from a campaign, or if they need to switch the

campaign they are currently on.

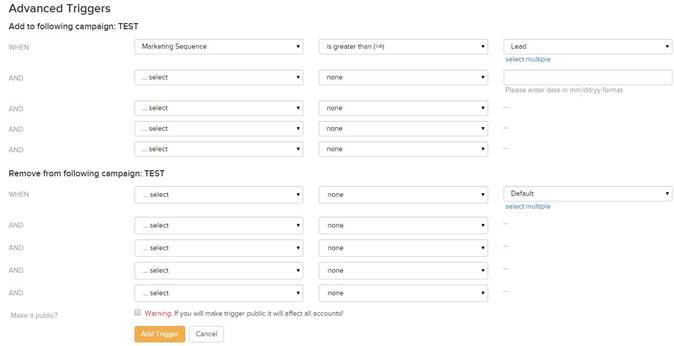

Advanced Triggers are the most powerful

triggers. These triggers allow you to create a rule based on any field or

combination of fields in the system. For example, you can tell BNTouch to add

someone to a campaign when their credit score is below 650, or to put someone

on an investor campaign when the “occupancy” on their loan is “investor”. You

could even create a trigger to add someone to a campaign when their monthly

income is over $10k and they prefer coffee over tea!

To learn more about what “Triggers” are

and how to use them in your marketing, please watch our “Creating New Campaigns – Triggers (Step 3)”

training video.

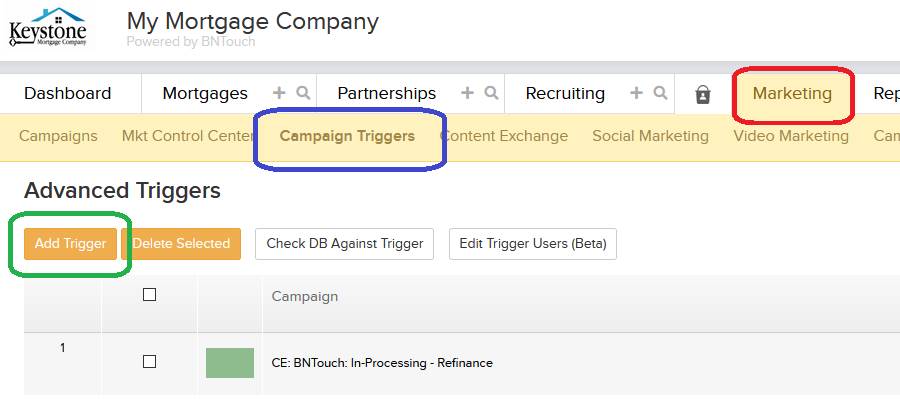

To create an advanced trigger in BNTouch,

go to your Marketing Tab, open a campaign by clicking the blue “Campaign Name”

link, and click the “Triggers” sub-tab. You can also click the “Campaign

Triggers” sub-tab of your Marketing Tab, choose the campaign you want to set a

trigger for, then choose whether to create a trigger for the Mortgages or

Partnerships database.

The examples below show how to setup

“Add” and “Remove” conditions of Advanced Triggers for specific

cases. Examples listed here will include explanations of how and why the

trigger will “Add” and “Remove” records from the campaign.

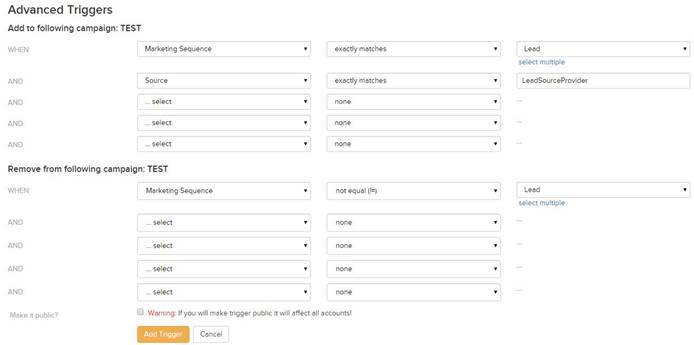

1. New Lead from

Lead Provider

Add: New leads are usually posted

into the “Lead” marketing sequence; that is why we have the first condition set

to “Lead”. The second condition should be specified to “Source” and look for

the specific provider’s name. You can disregard the second condition if you

want to set up a trigger for all leads.

Remove: When you move your records

out of the “Lead” marketing sequence, you will want to stop the “New Lead”

campaign and start some other follow-up campaign.

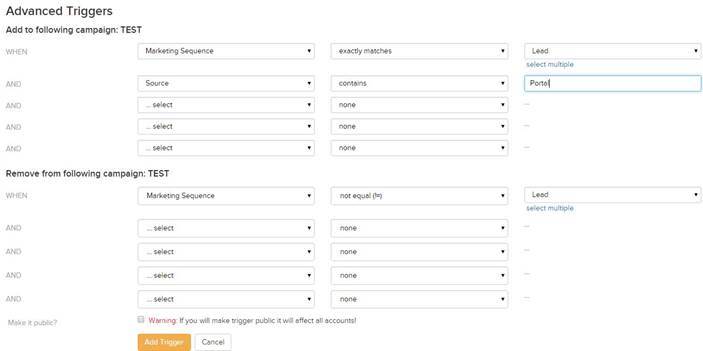

2.

NEW LEAD FROM BORROWER & PARTNER PORTALS

ADD: When the lead is coming from a

Portal site, the “Source” field contains following data: “Portal – REFERRAL

NAME”. “REFERRAL NAME” is the name of the person who submitted the lead. If

your second condition is set to “Source” “contains” “Portal”, it will include

all leads that are coming from Portals.

REMOVE: When you move your records

out of the “Lead” marketing sequence, you will want to stop the “New Lead”

campaign and start some other follow-up campaign.

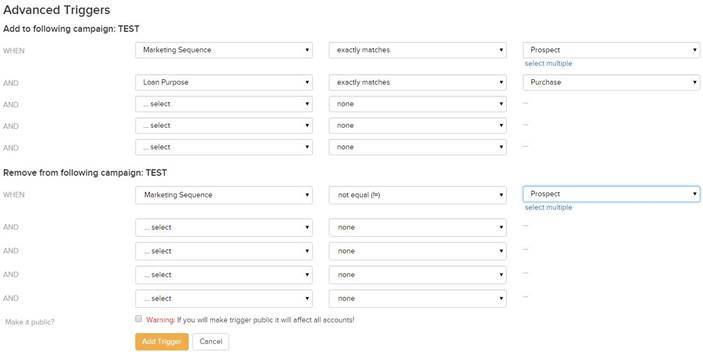

ADD: The first condition is set to

“Marketing Sequence” “exactly matches” “Prospect”, and the second condition

should be set to “Loan Purpose” “exactly equals” “Purchase”. You can also set a

similar trigger for “Loan Purpose” “exactly equals” “Refinance”.

REMOVE: When you move your records

out of the “Prospect” marketing sequence, you will want to stop this campaign.

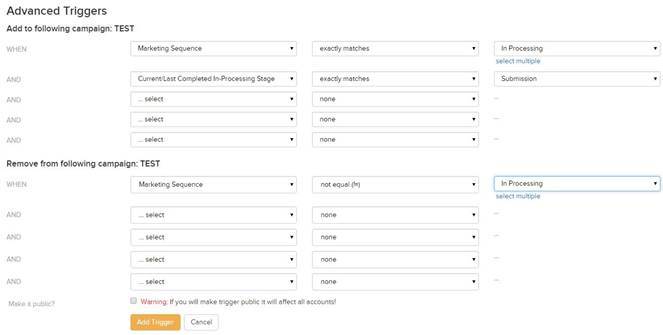

4.

IN PROCESSING – LOAN SUBMITTED TO UNDERWRITER

ADD: The first condition is set to

“Marketing Sequence” “exactly matches” “In-Processing”. The second condition is

set to “Current/Last In-Processing Stage” (very bottom of the field list)

“exactly matches” “Submission”. Your stage name can be different as the

processing stages are fully customizable.

REMOVE: This trigger does not

necessarily need a removal condition, but we still advise you to set it to stop

the campaign when the record is moved out of the “In-Processing” stage.

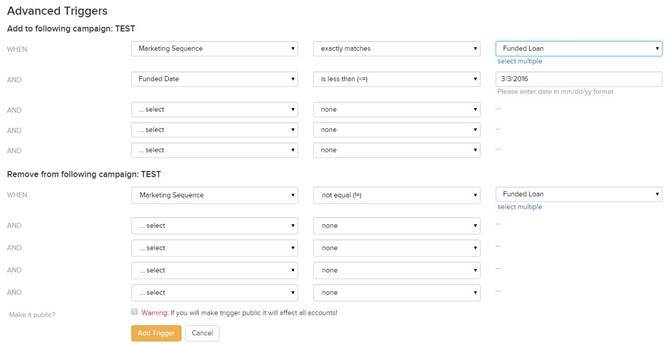

5.

PREVIOUSLY FUNDED LOANS

There should be a difference in your marketing

message if it is sent to the previously funded loan or newly funded loan. This

“previously funded loan” campaign doesn’t have any “thank you” emails, and it

starts on the next anniversary of the loan.

ADD: The first condition should be

set to “Marketing Sequence” “exactly matches” “Funded”. The second condition

should be set to “Funded Date” with the “less than” option. The value for the

“Funded Date” condition should be the day the trigger is set up (or close to

it).

REMOVE: This trigger does not

necessarily need a removal condition, but we still advise you to set it to stop

the campaign when the record is moved out of the “Funded” stage.

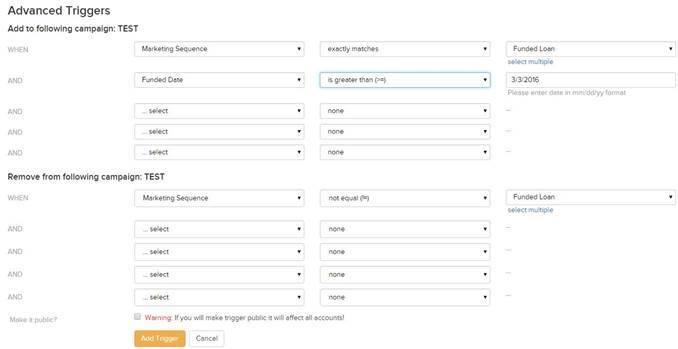

This campaign should be set for all loans that

will be closed after the initial setup of your CRM.

ADD: The first condition should be

set to “Marketing Sequence” “exactly matches” “Funded”. The second condition

should be set to “Funded Date” with the “more than” option. The value for the

“Funded Date” condition should be the day of the trigger is set up (or close to

it).

REMOVE: This trigger does not

necessarily need a removal condition, but we still advise you to set it to stop

the campaign when the record is moved out of the “Funded” stage.

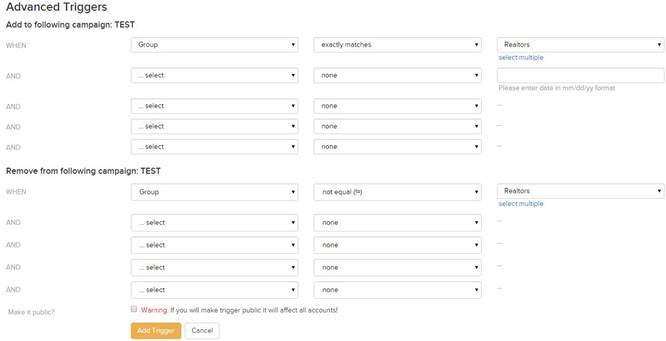

7.

NEWSLETTER FOR REALTOR GROUP

ADD: The only condition for this

trigger should be set to “Group” “exactly matches” “Realtors”. This could be

set to any group depending on the purpose of the campaign. You can create

an unlimited number of groups in your CRM.

REMOVE: The only condition should be

set to “Group” does “not equal” “Realtors”.

8.

NEWSLETTER OR BIRTHDAY CAMPAIGN FOR WHOLE MORTGAGE DATABASE

If you would like to start any campaign for an

entire database (mortgages in this example), you can use following condition:

ADD: In this case, the only condition

will be that “Marketing Sequence” “is greater than” “Lead”.

REMOVE: You don’t need do add a

removal condition for this campaign example.

Want to Learn More?