Options – New URLA1003 Form

Configuring 1003

Forms in BNTouch

1003 forms are an important part of the

mortgage process, so you need to be able to make the process of filling them

out and submitting them as easy and accessible as possible for your borrowers.

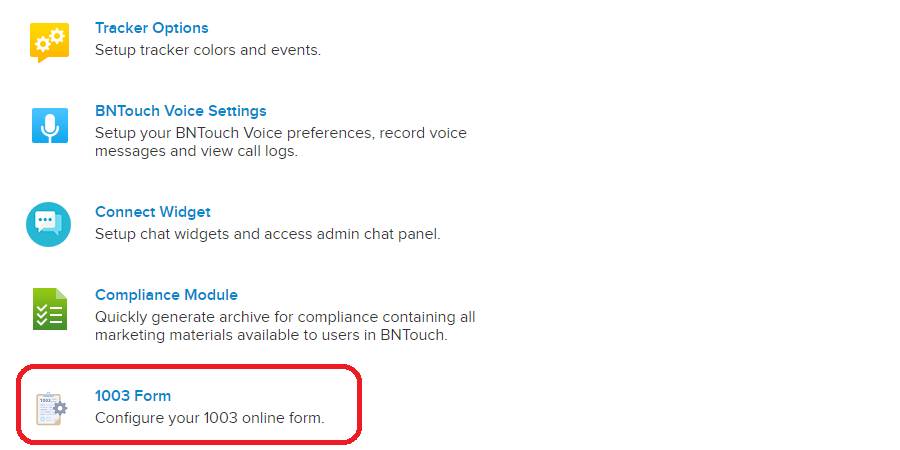

In the Options Tab of your BNTouch CRM, you can use the “1003 Form” section to

customize your form for your business. Here, various settings for the form are

sorted into three sub-tabs at the top of the page. These settings can only be

seen and modified by the master account holder.

Form Settings

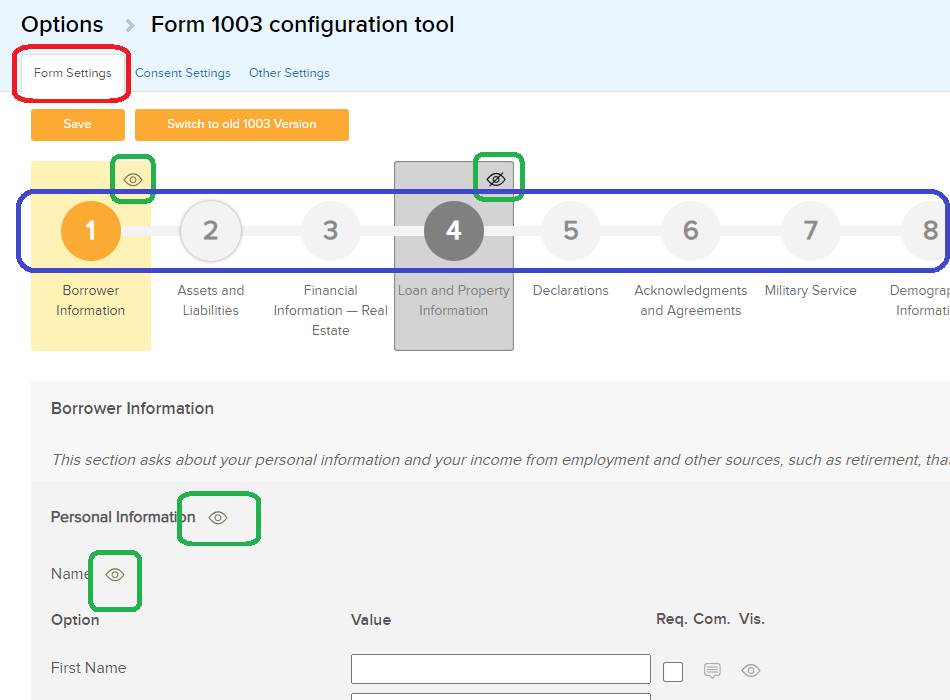

The first sub-tab, “Form Settings,”

contains a listing of the various possible fields for the 1003 form. Here, you

can choose what appears on your borrowers’ forms and what they need to enter

when completing them.

The top-most option here separates the

form into numbered sections. You can click any of the numbers above these

sections to display the fields contained in a particular section. You can also

elect to show or hide an entire section by clicking the eyeball icon for the

selected section. Within each section of the form, fields will be listed in

various sub-sections. Like before, you can hide or show any of these

subsections using the eyeball icons.

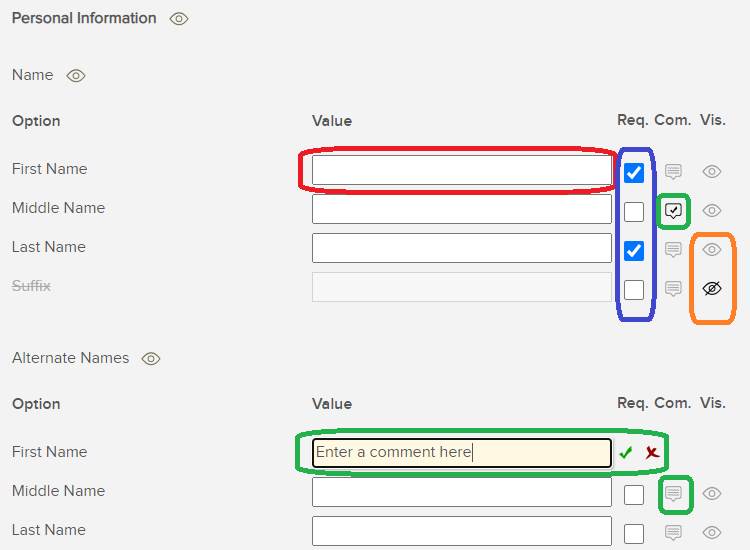

For each field, the name of the field

will display under “Option.” The next column will be a text box; the text

entered here will be default text that will appear when a borrower starts

completing the form. If you don’t want any default text to appear for a field,

leave this box blank. The checkbox to the right can be used to note any field

as “Required.” Borrowers will not be able to submit a form if any fields marked

as “Required” are empty.

The next column will have a “Speech

Bubble” icon. When clicked, a new text box will appear where you can add a

comment that will appear for the field. This comment will appear next to the

field when a borrower is filling out the form, so it can be used to provide

help or instruction for them. Enter the comment in the new text box, then click

the checkmark icon to save it. You can use the “X” icon to clear any comments

for a field.

The last column will have another eyeball

icon that can be used to hide or show any field. Whenever you add information,

change a comment, or toggle any setting for your 1003 form, be sure to click

the “Update” button at the top or bottom of the page to save the changes.

You can also switch between the new and

old versions of the 1003 form using the button above the section list. If you

switch from the old 1003 form to the new version, please be aware that any

currently incomplete applications in your clients’ loan portals will be

restarted. Any information they have entered in these partially completed forms

will be lost and not transferred to the new form. To confirm this action, click

the “Continue” button.

Consent Settings

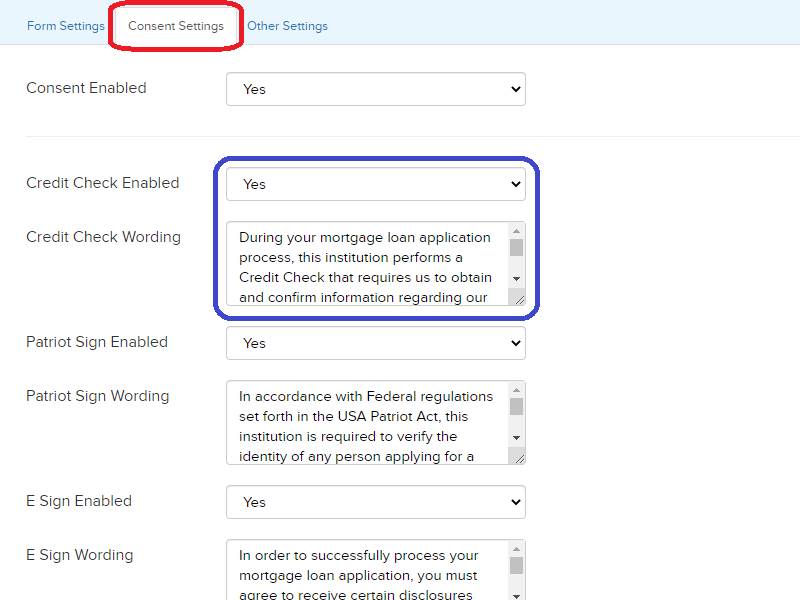

The second sub-tab, “Consent Settings,”

allows you to customize the prompts for consent that borrowers will see while

completing the 1003 form. The first menu option will enable or disable consent

prompts on the form, and the drop-down menus below will do the same for

individual elements requiring consent, including signatures for a Credit Check,

the USA Patriot Act, and completion of the 1003 form.

Below each menu, a text box will display

the message that will appear for each consent prompt. You can change any of the

messages that appear or use your own text. When finished, click the “Update”

button at the bottom of the page to save any changes.

Other Settings

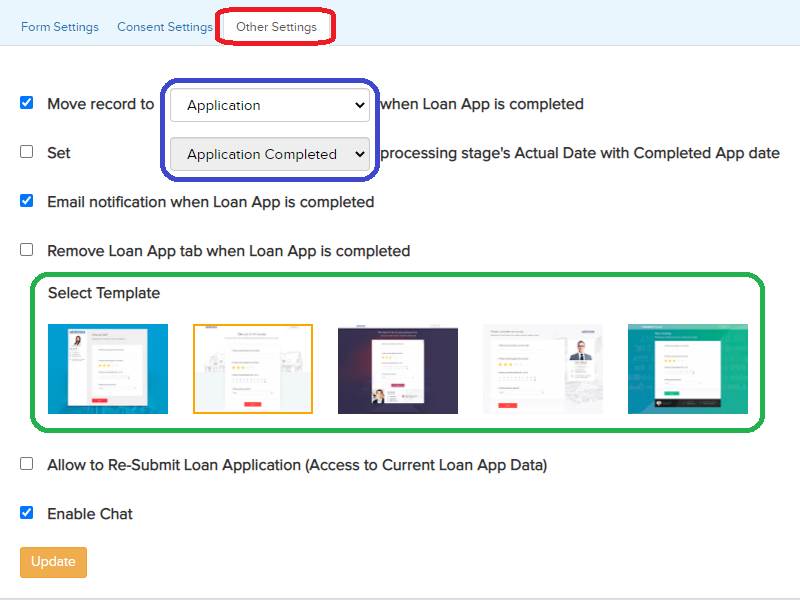

The third sub-tab, “Other Settings,”

contains miscellaneous settings for your 1003 form. The first option, if

enabled, will automatically move a borrower’s record to a new step in the

marketing sequence pipeline when they complete their loan application. The step

can be modified using the drop-down menu.

You can also choose to have the date that

a client completes the online 1003 form in their loan portal appear as the

“Actual Date” for an In-Processing stage of their record in your CRM. If you

enable this feature, choose which field will use the completion date using the

drop-down menu.

The next two options also automate

actions when a borrower completes their 1003 form, including sending you an

email notification and removing the Loan App tab from the borrower’s portal

site.

Below, a style template can be chosen for

the 1003 form page. To enable live chat with the borrower while they fill out

the form, check the “Enable Chat” box. When finished, click “Update” to save

any changed settings.

Want to Learn More?