Modules – Rate Refinance Miner

Customize your

Daily Refinance Alerts

Many of your current mortgage clients

could benefit from refinancing without knowing about it. The BNTouch Rate

Refinance Miner can discover new refinance opportunities for your borrowers for

you, checking your database automatically each night to find records based on

current rates and goal rates. You can configure your own rates for various

scenarios, set a minimum change in rate that will trigger alerts in your

Dashboard tab, and even receive regular email summaries for these potential

refinances.

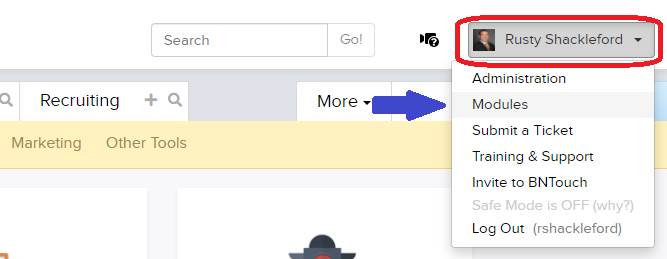

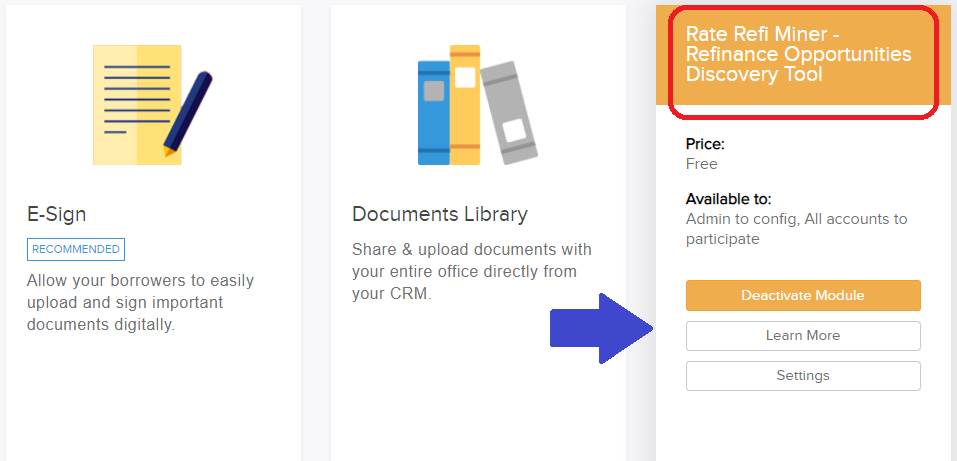

This is a free module without any extra

monthly cost, but it is optional and must be enabled for your account if you

wish to use its features. If you are an administrator for your account, you can

enable the Rate Refinance Miner from the user menu in the upper-right corner of

your CRM. To do so, open the “Modules” section, then scroll to the “Rate Refi

Miner” panel. You can hover over the panel for support materials, and you can

enable the feature by clicking the “Activate Module” button.

How Does the

Refinance Miner Work?

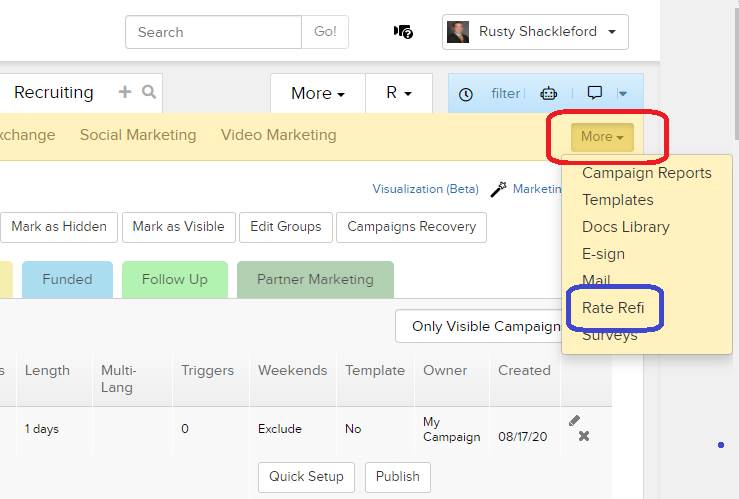

After the Refinance Miner is activated,

you will see an extra option in your Marketing Tab titled “Rate Refi”. Here,

you will see a list of alerts active for your account. This list will be empty

at first, but each night, the Rate Refi Miner will check all records in your

account for rates that have changed by a certain, specified amount. It will

create a new alert here for each matching record it finds, letting you know

exactly which clients you can get in contact with about a potential savings

through refinancing.

Please note that the Refinance Miner

looks at particular fields in your clients’ records in

your CRM, so it will only create alerts if you have filled in these relevant

fields. These include the Loan Amount, Loan Term, Property Type, Loan Program,

Loan Type, and Rate fields in the “Mortgage Info” sub-tab of a mortgage record.

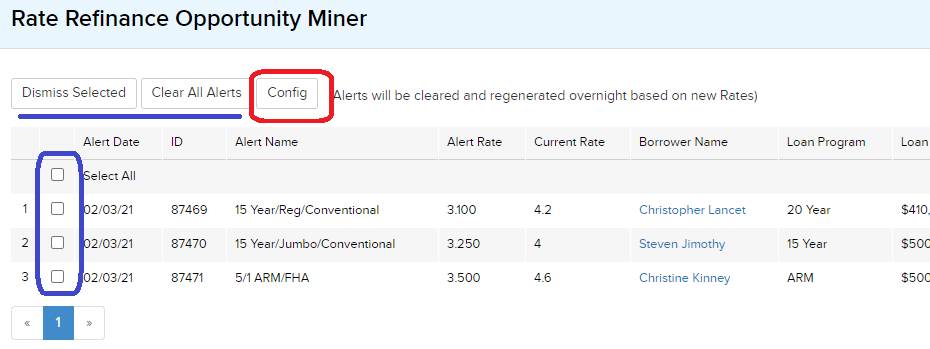

When you first enable the Refinance Miner

for your CRM, it will be pre-populated with a series of alert values based on

the most popular loan scenarios. You can customize any of these alert criteria

and create new alert triggers by clicking the “Config” button on this page.

Configuring Your

Refinance Alerts

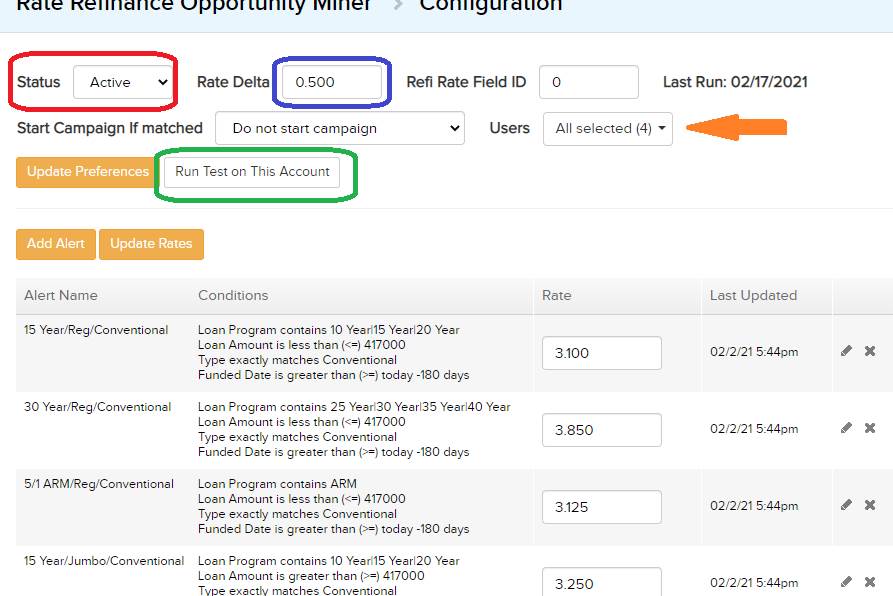

On the Configuration page, you’ll see a

series of options above and a list of alert types below. The menus at the top

of the page let you determine how the miner checks through your mortgage record

database. The “Status” indicator lets your turn this feature on and off.

The “Rate Delta” is the minimum amount of

change that a rate needs to differ from that in a client’s record in order to trigger an alert. By default, this value starts

at “0.5”. This means that if the miner finds a record with a rate that is more

than 0.5 percent away from the current rate you have listed, it will make an

alert for you to contact that client about refinancing.

The “Rate Field ID” will determine what

field in the client’s record the miner will look at for their current rate.

This will default to the “Rate” field from the “Mortgage Info” sub-tab. The

date of the last rate check will be shown to the right.

If you would like a campaign to

automatically run for any clients that are matched by the miner, you can choose

it from the “Start Campaign if Matched” drop-down menu. Similarly, you can set

the miner to only look for records belonging to specific users in your CRM

using the second menu.

Once you have configured the miner settings

to your liking, click the “Update Preferences” button to save these changes.

You can also use the “Run Test on This Account” button to do an immediate check

of the records in your database and generate alerts accordingly.

Creating and

Editing Alerts

Below, you will see a list of all alert

criteria set for your account. This will originally include only those added by

default with the module, but you can always add new alerts using the button

above the list. As you see below, each alert has a name for your own reference,

trigger criteria in order to identify records that

will activate the alert, and a rate.

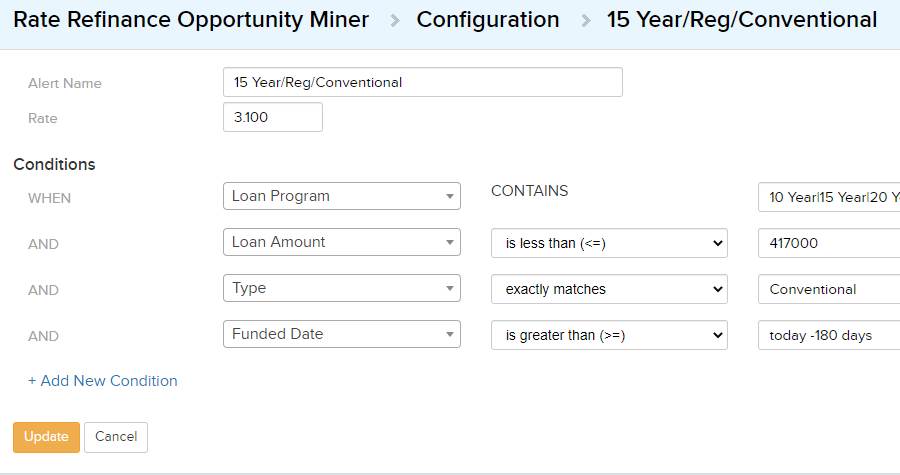

When you click “Add Alert” or edit an

existing alert using the pencil icon to the right, you can change the name and

rate for that alert. You can also modify trigger conditions below. These

triggers function similarly to marketing campaign triggers, so you can use the

rows labeled “When” and “And” to set any values that must be matched in client

records to cause an alert.

Using the drop-down menu, find an

appropriate field. Next, use the second menu to determine whether the value you

set to the right must match, be greater than, be lesser than or equal to, or be

contained in that client’s record for this field. Make sure to compare the

values listed here to those you use for your funded loans. For example, when

the miner looks at the “Program” field, it will not see “10-yr” and “10 Year”

as “Exactly Matching”.

You can add as many conditions as you

need to further narrow the alert selection, and you can use the “Add New

Condition” link to add more rows to the list. When finished, click “Create” or

“Update” to save the alert.

Setting New

Rates for the Miner

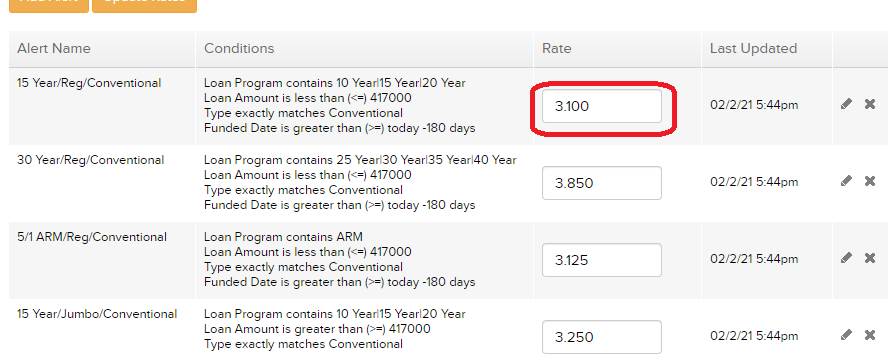

Now that you have configured settings for

the miner and created a list of criteria for it to use, you can simply update

it with new rates here to use in its nightly checks. For existing alerts, you

can simply change the rate value in the list below, then click the “Update

Rates” button to save the changes. The miner will now use the updated values

when it searches through records overnight and add alerts for records that match.

Where to Find

and Use Refinance Alerts

Once the miner generates alerts from your

client database, you can find them in the “Rate Refi” section of your Marketing

Tab. These same alerts can also be seen in your Dashboard Tab when you first

log in. In the “Alerts” sub-tab, you’ll see a “Rate Refinance Opportunity

Miner” section added to the “Refinance” panel.

Wherever you view these alerts, you’ll see the

date the miner found the matching client, which alert the record triggered, the

new rate and the one currently listed for the client, a link to the client’s

record, and additional details for that borrower. You can dismiss any of these

alerts once you have contacted the client by checking the boxes to the left and

clicking the “Dismiss Selected” button above the list. You can also remove all

current alerts using the “Clear All Alerts” button.

Want to Learn More?